Hi, my name is Joe and I’m a slacker. I promised regular updates to my review of Dave Ramsey’s Financial Peace University (FPU), in which I am enrolled, but have failed to deliver.

I am ashamed.

To make it up to you, I’m offering a bonus: until the end of July, all new RSS subscriptions are free. That’s right, free, as in zilch. Sign up quick and take advantage of my remorse. Subscriptions after the bonus period will be at least triple the bonus price!

If you found us through a search engine and are looking for the full Monty on Ramsey’s FPU, you’ll want to start here. The 13-week course is almost half over and I can say with a straight face that I’m happy with the content and the price we paid. I’d do it again, and recommend it to others. In fact, I will do it again because my membership fee entitles me to attend refresher courses anywhere, anytime, at no additional charge. It will be good to go back again later and brush up on the things I’m less interested in right now, such as college and estate planning.

My interest wanes

The first few weeks of FPU courses were very good for me: the importance of saving, how men and women think about money differently, how to plan cash flow (or how to make a budget that works), the evil of debt and how to get out of it (not necessarily in that order). But now that we’re moving on to more advanced topics, such as insurance, investments, and estate planning, I am less engaged in the content. Don’t get me wrong—the information is just as good and just as well presented, but my personal investment in it (my motivation) is smaller. There are reasons for this, and I understand the reasons, and it’s not a fault in the course itself.

The members area

I should have mentioned in an earlier post about the Members Area that those enrolled in FPU get access to (image used with permission). It’s full of good resources to supplement your reading and course content, such as budget spreadsheets, debt reduction calculators, discussion forums, and so on. There is a downside: you only have access to it for as long as your course lasts and then you have to convert to a paid membership if you want to keep getting in. It would suck to do all of your budgeting and debt-reduction planning online, only to lose that work when your free access is cut.

I recommend it

My results have not been as dramatic as those in FPU’s marketing, but they are positive results. We are saving money now (weren’t before) and have a workable plan to get out of debt. No magic unicorns that poop $100 bills, but good information that will serve us well for a lifetime. In my opinion, you can head over to Financial Peace University and sign up with confidence that you’ll get your money’s worth.

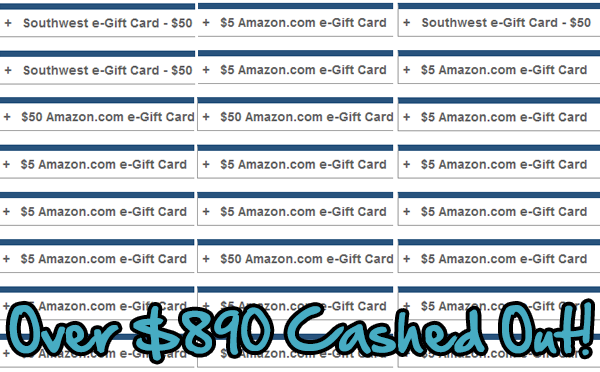

I like cashcrate better than Fusion Cash just because it is less obnoxious in its promotional graphics and text and because the site is faster loading. You go to the members area and can choose from offers using simple text, not full-on logos like Fusion Cash uses. The screen shot shows only the first nine of many, many offers. The site also warns you which offers require a credit card to sign up for, a nice feature.

I like cashcrate better than Fusion Cash just because it is less obnoxious in its promotional graphics and text and because the site is faster loading. You go to the members area and can choose from offers using simple text, not full-on logos like Fusion Cash uses. The screen shot shows only the first nine of many, many offers. The site also warns you which offers require a credit card to sign up for, a nice feature.